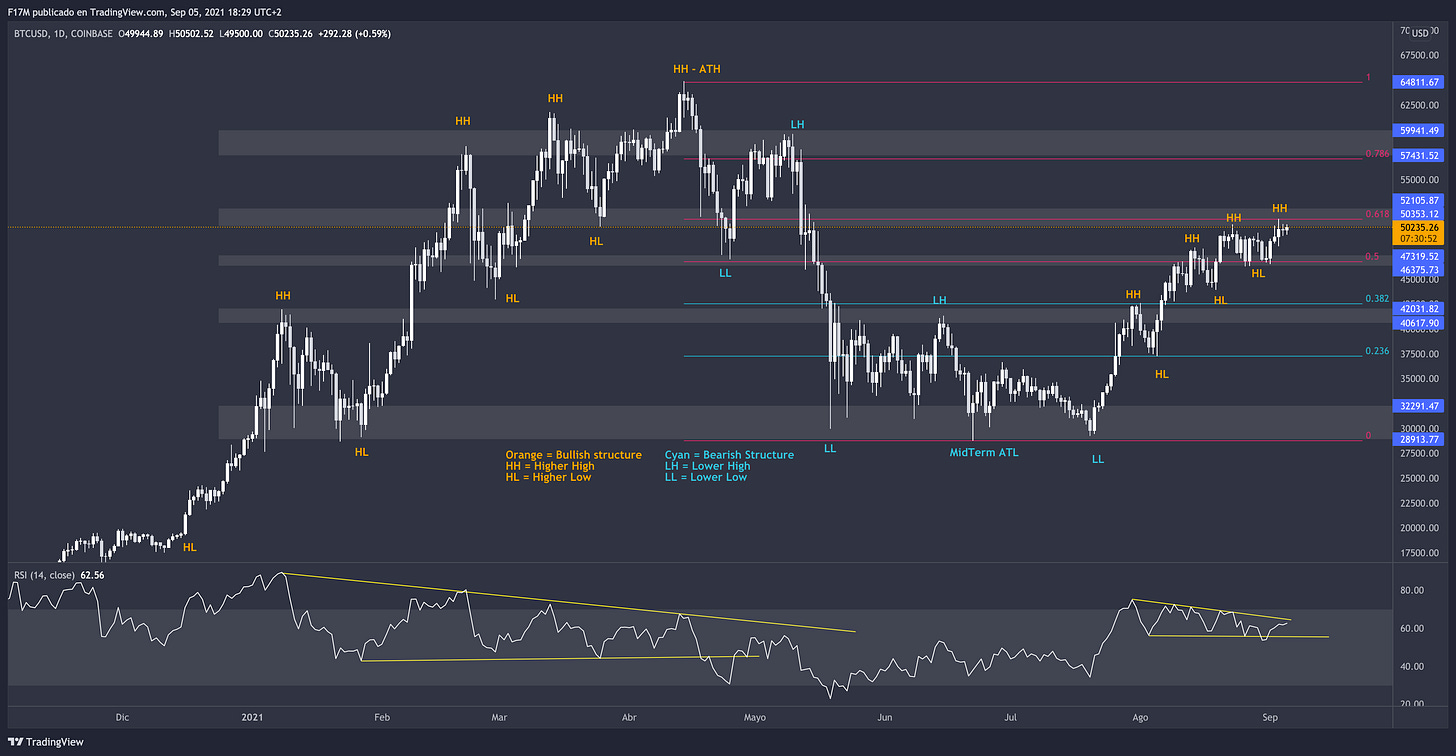

This week BTC price has been fluctuating between 0.618 and 0.5 Fibonacci levels as we discussed the last week.

Long-term holders and mid-term holders are accumulating Bitcoin under $50K key level, and we are near to see a strong break up to 0.786 Fibonacci level in the next days / weeks.

Market Structure

Short term, mid term and long term structure: Bullish.

BTC remains hitting Higher highs (+ $ 51K) and Lower highs. The low was a double bottom at $ 46.5K.

Price Action

As I wrote the last week, I have liked to see RSI going into the triangle and now it’s going to the upper part of it.

For the next week I think we could see a RSI breaking up the triangle, and then a strong move up in the BTC price. Due to the actual consolidation for the last two weeks, IF BTC breaks the 0.618 fibonacci level, the move will be strong and IMO, the next stop should be 0.786 level ($ 56K).

Also, it should does a pull back, but IMO the pullback would be around $ 53.2K, and not $ 51K. Leaving a lot of people behind the scene waiting for a good entry.

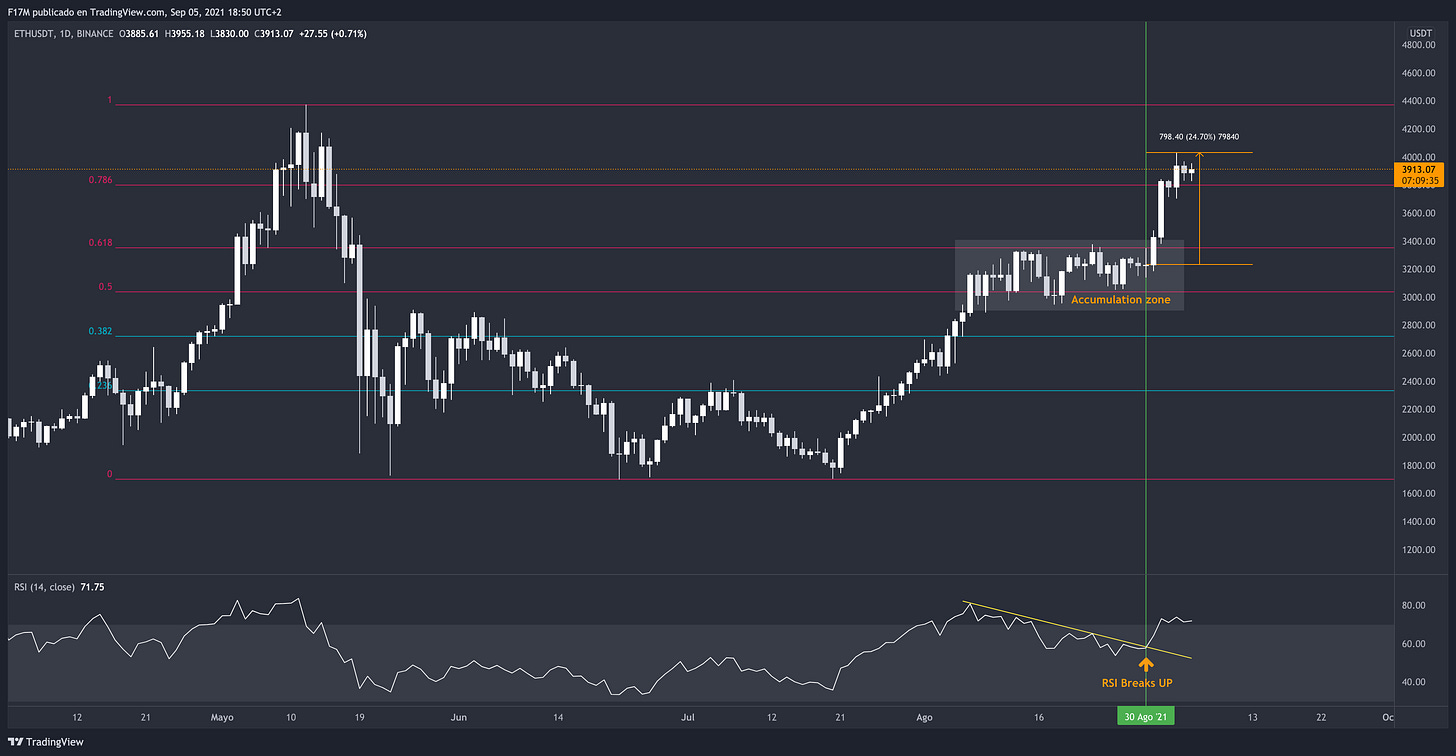

Something like ETH does the last week.

On-Chain Analysis

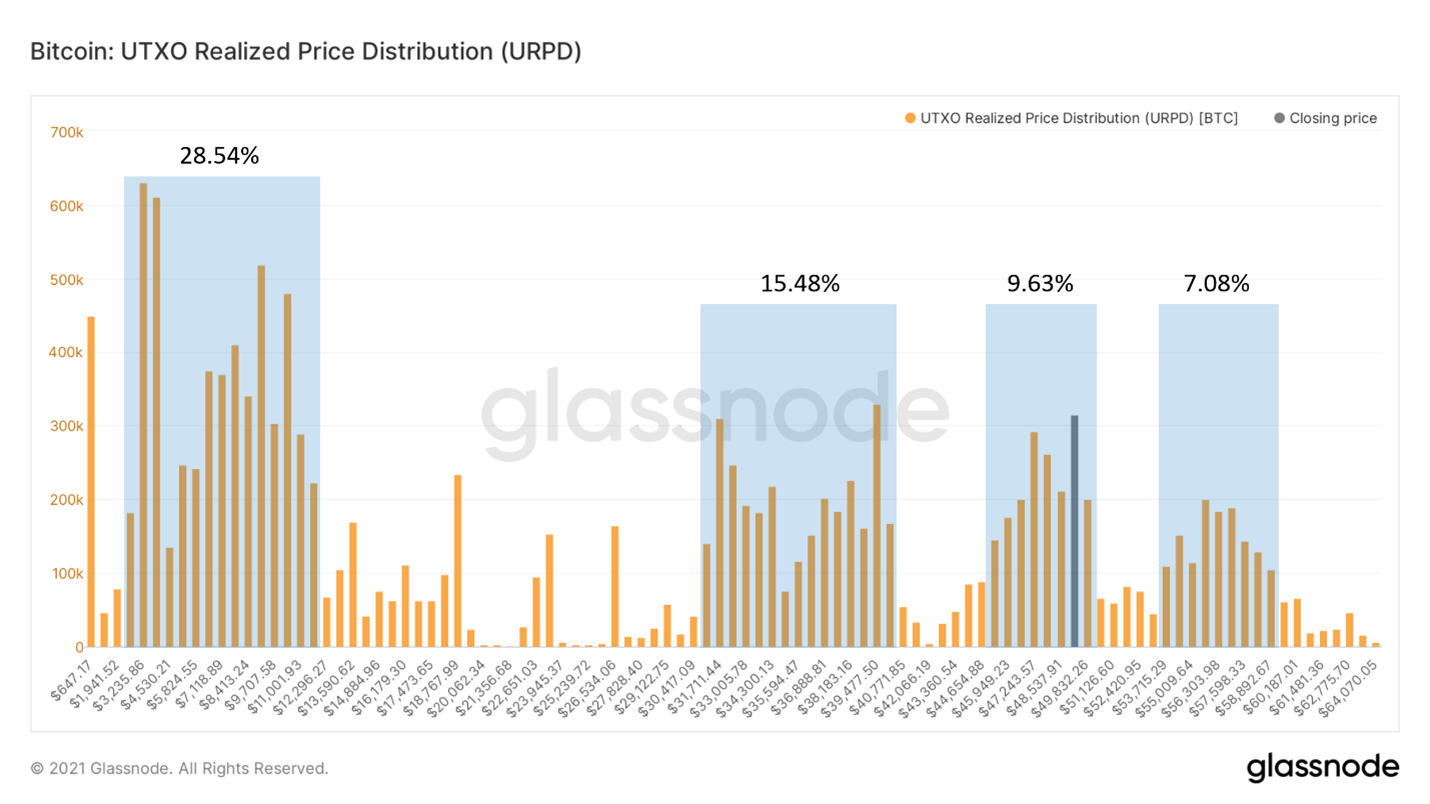

Currently we are in the top zone of a clusters of on-chain volume. This means that 9,63% of total BTC supply has been moved in this price range.

The next cluster starts at $ 54K and finalize at $ 59K. This is why I think the next move up will be violent and fast, from $ 51K to $ 56K. Also, I think the price could doesn’t go bellow $ 54K supporting by this cluster.

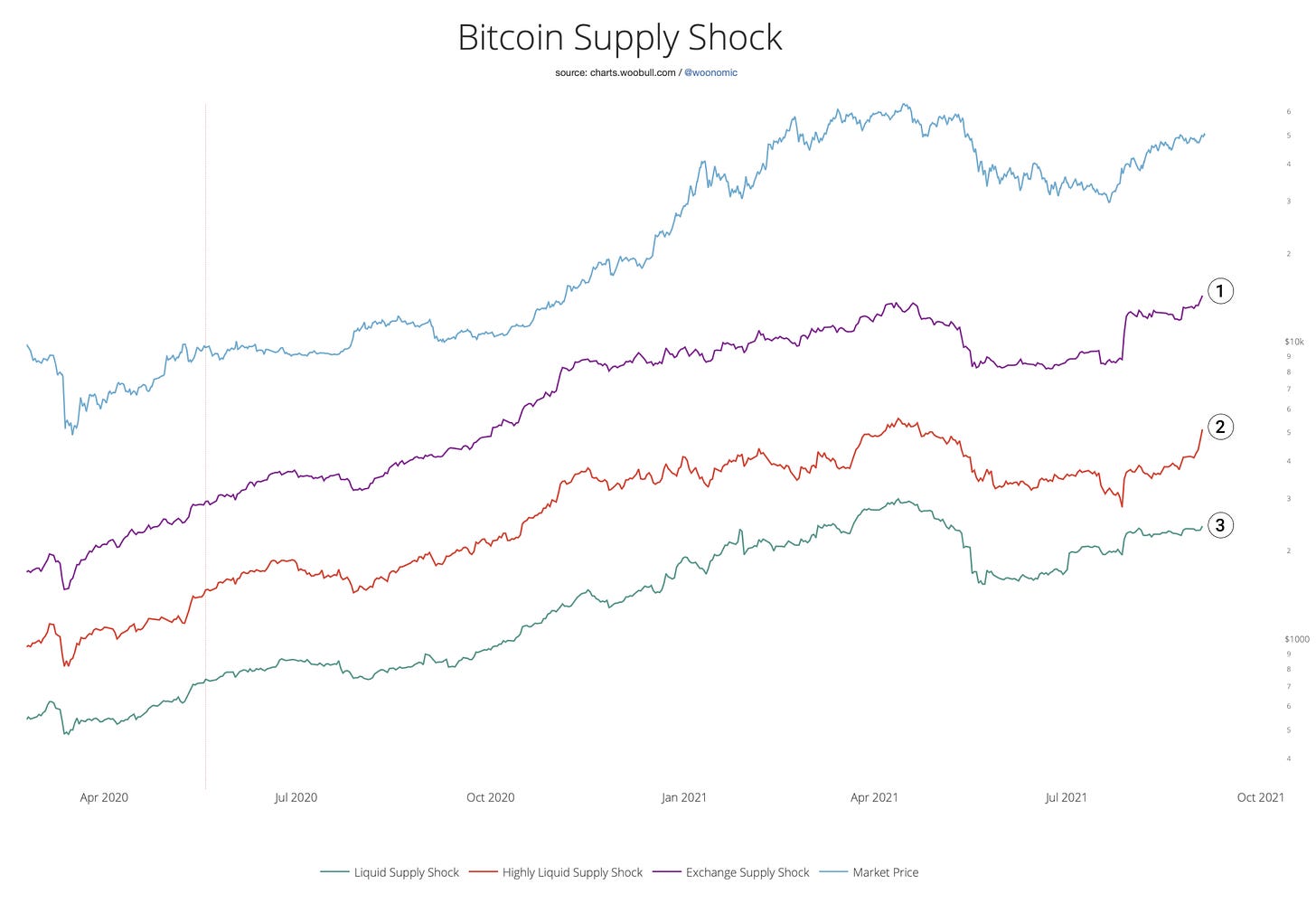

Meanwhile, BTC Supply shock remains growing and it suggests we will see a big bull-run during, at least, Q4 2021 and Q1 2022.

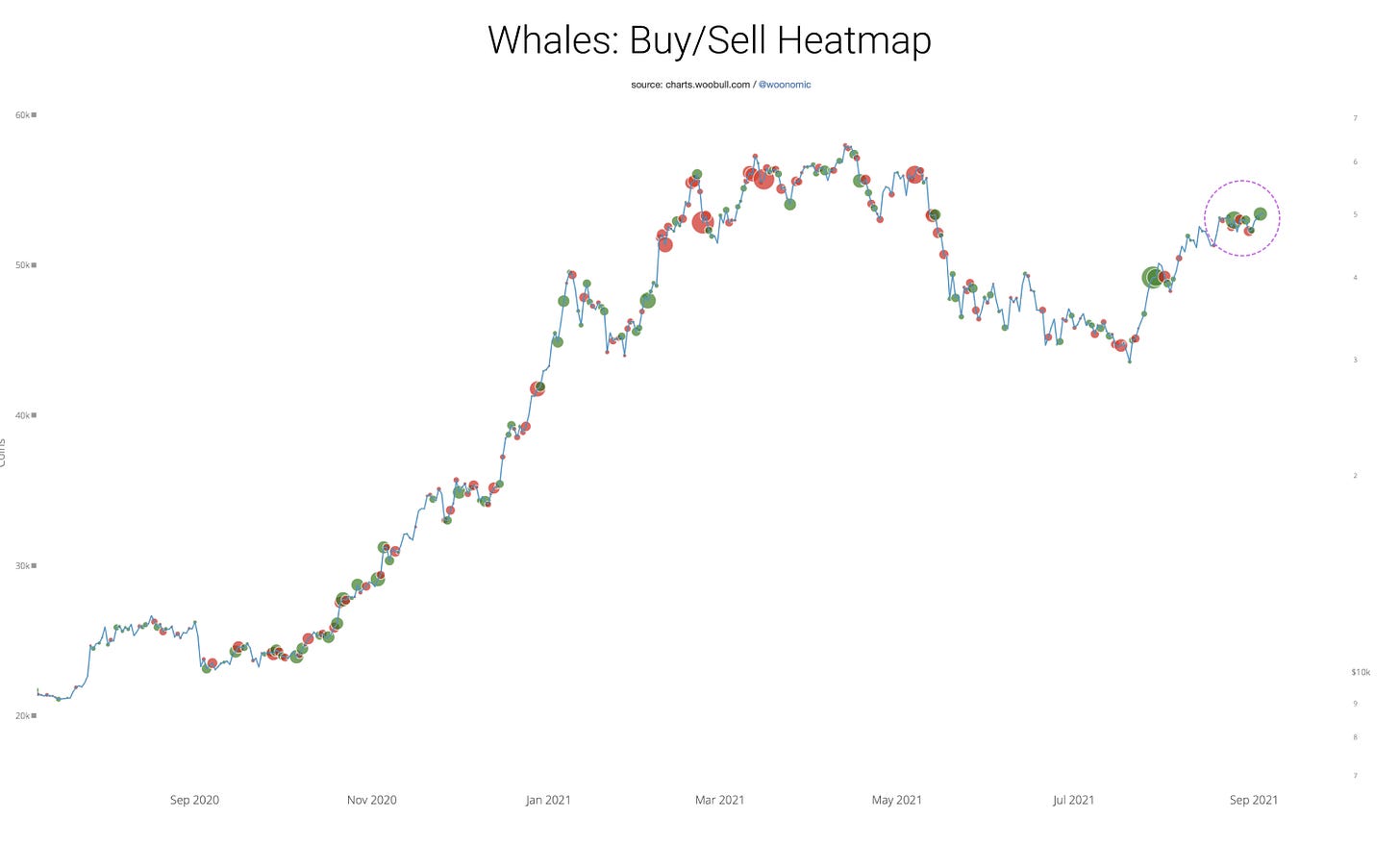

As Willy Woo showed in his newsletter, whales remain buying BTC strongly bellow $ 50K. This suggests the price should goes up from this key price and this will be a strong support for the next weeks. ($ 50K = Strong accumulation zone)

Also, we are not seeing sells (exit liquidity) from old coins while BTC is going up. So we can discard the “cat dead bounce” and we can think this is the second wave of bull run like 2013, and not like 2017.

Portfolio Allocation

For the next week / month my main bags (large caps) are:

FTT

ETH

LUNA

SUSHI

ZCX

Suggestion: Have at least 15-20% USD available to buy possible dips. Don’t be 100% exposed to the market.

It’s possible to see a “long squeeze” in ETH and it will affect to other altcoins.

Also could be nice to have a BTC bag IF the RSI breaks up.

FM.